In the rapidly evolving landscape of technology, few narratives capture attention and investment like artificial intelligence (AI). Nvidia and Microsoft have emerged as frontrunners in this domain, demonstrating resilience against early-year market volatility caused by geopolitical tensions, such as export restrictions from China and international tariffs. Their recent resurgence is not just a market rebound; it signifies a transformative shift in how we interact with technology, driven by the AI revolution. According to analysts, these companies are on the verge of reaching a remarkable milestone: a combined market capitalization of $4 trillion, with Nvidia likely achieving this first due to its pivotal role in AI hardware.

Nvidia: The Driving Force Behind AI Growth

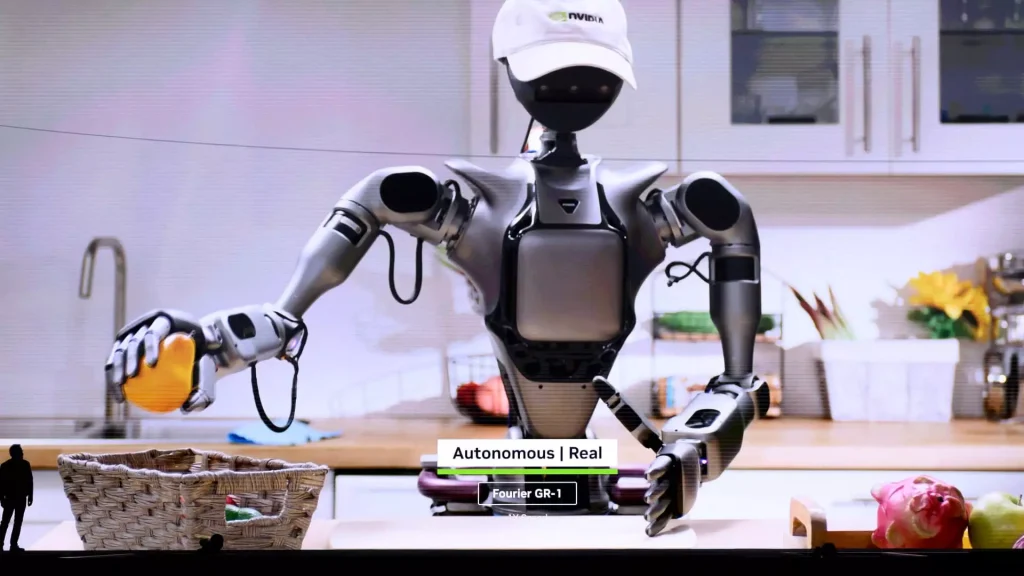

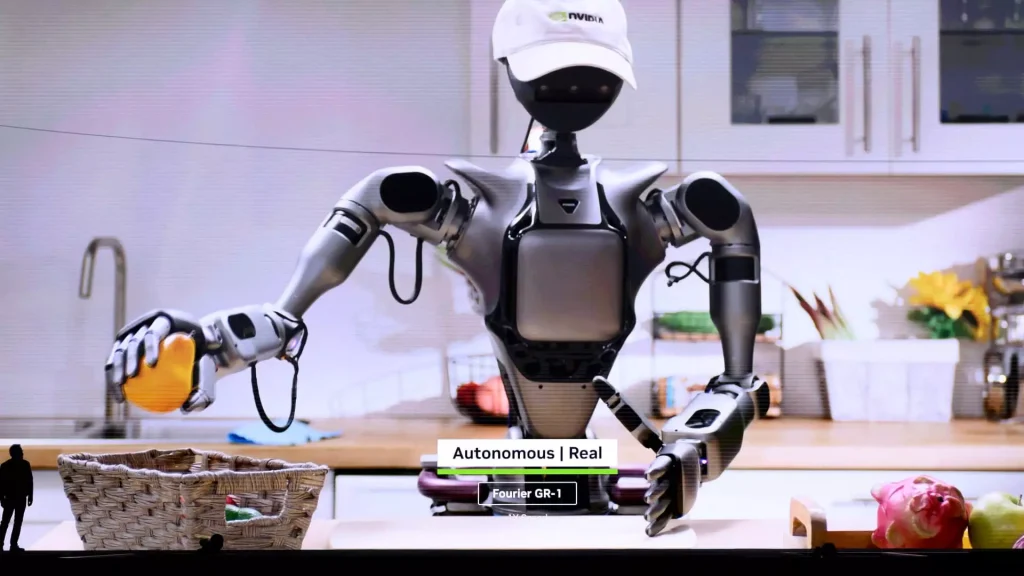

Nvidia stands out as a dominant player in the AI sector, primarily due to its specialized processors designed for AI applications. Unlike other chip manufacturers, Nvidia’s technology serves as the backbone for various industries, including autonomous vehicles, cybersecurity, and robotics. Analysts estimate that for every dollar spent on Nvidia’s products, there is an $8 to $10 ripple effect throughout the technology ecosystem. This multiplier effect underscores Nvidia’s central role in a market increasingly reliant on data-intensive applications that require exceptional computational capabilities.

CEO Jensen Huang has effectively positioned Nvidia as a near-monopoly in AI chip technology, leveraging direct enterprise demand to solidify its market dominance. For investors focused on long-term innovation, Nvidia represents a strategic investment opportunity that combines stability with dynamic growth potential.

Microsoft: Integrating AI with Cloud Infrastructure

Microsoft’s strength lies in its ability to integrate AI within its already dominant Azure cloud platform. While Nvidia provides the necessary computing power, Microsoft applies that power to develop software and cloud solutions that drive practical AI applications. This synergy not only boosts Microsoft’s market valuation but also allows it to expand its AI services across various sectors, from enterprise productivity to consumer-focused applications.

The company’s stock has reflected this growth, with gains exceeding 30% in recent months, signaling strong investor confidence. Microsoft competes vigorously against other major players, such as Amazon and Google, in the cloud services market, further establishing its position within the AI ecosystem. This competitive landscape enhances the overall value proposition for Microsoft as it continues to innovate and diversify its offerings.

The AI Ecosystem: Competition and Collaboration

While Nvidia and Microsoft are at the forefront, it is crucial to recognize the broader dynamics of the AI ecosystem. Competitors like Amazon Web Services (AWS), Google Cloud Platform (GCP), and Advanced Micro Devices (AMD) are actively investing in AI, either by developing their own AI-optimized chips or by providing AI-driven services. This competitive environment illustrates that the AI revolution is not solely reliant on a few dominant players but is fueled by a network of software platforms, hardware manufacturers, and cloud service providers.

This interconnected growth model ensures that no single entity can monopolize innovation indefinitely, fostering a culture of competition that drives technological advancement. From a broader perspective, this ecosystem exemplifies the principles of competitive capitalism, encouraging innovation while preventing monopolistic tendencies that could stifle progress.

Investor Sentiment and Future Prospects

The current market sentiment surrounding AI stocks reflects more than just short-term enthusiasm; it indicates a significant strategic shift in technology investment and capital allocation. Major tech companies are doubling down on AI infrastructure, which invites both scrutiny and admiration for their forward-thinking strategies. However, the soaring valuations associated with these stocks warrant caution. While the prediction of a $4 trillion market cap suggests an unstoppable upward trajectory, investors must remain aware of the inherent risks and cyclical nature of technology stocks.

Despite these risks, the transformative potential of AI across various industries—from healthcare to autonomous systems—supports a sustained optimistic outlook. Investors should approach this landscape with vigilance and discernment, weighing the potential for growth against the realities of market fluctuations.

In summary, Nvidia and Microsoft are not just defining the AI era through their impressive market capitalizations; they are fundamentally reshaping the technological landscape. Their success embodies the convergence of ambitious technological advancements and strategic market positioning, offering valuable insights for investors and industry stakeholders alike. As these companies continue to lead the charge in AI development, their roles in the evolving tech architecture will be crucial for understanding the future of technology and investment opportunities in this dynamic field.