As the investment landscape evolves rapidly, certain stocks are emerging as essential components for a well-rounded portfolio. Here, we explore five companies poised for significant growth: Nvidia, Netflix, Boot Barn, Amazon, and Philip Morris. Each of these stocks reflects unique strengths and market opportunities that investors should consider.

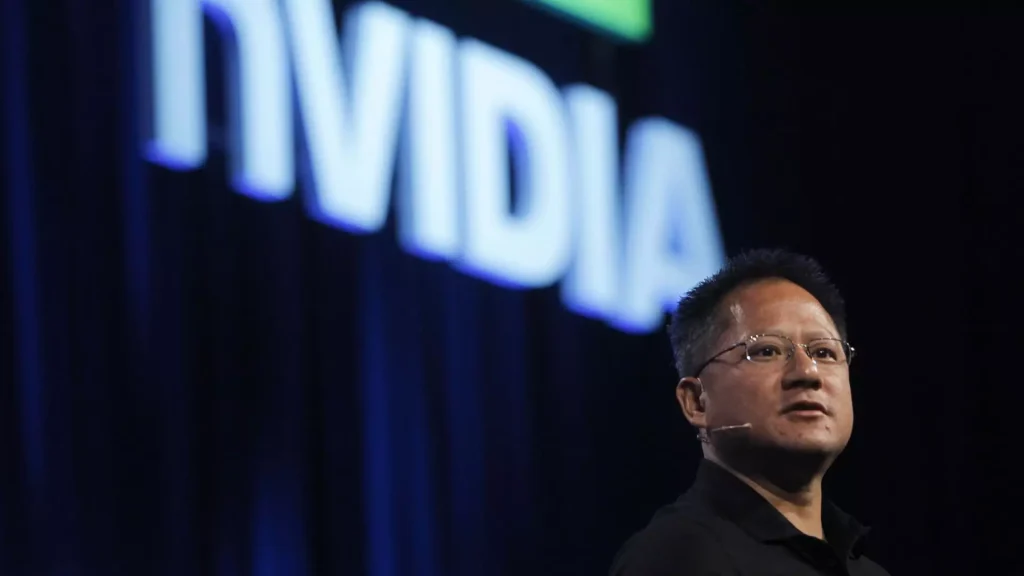

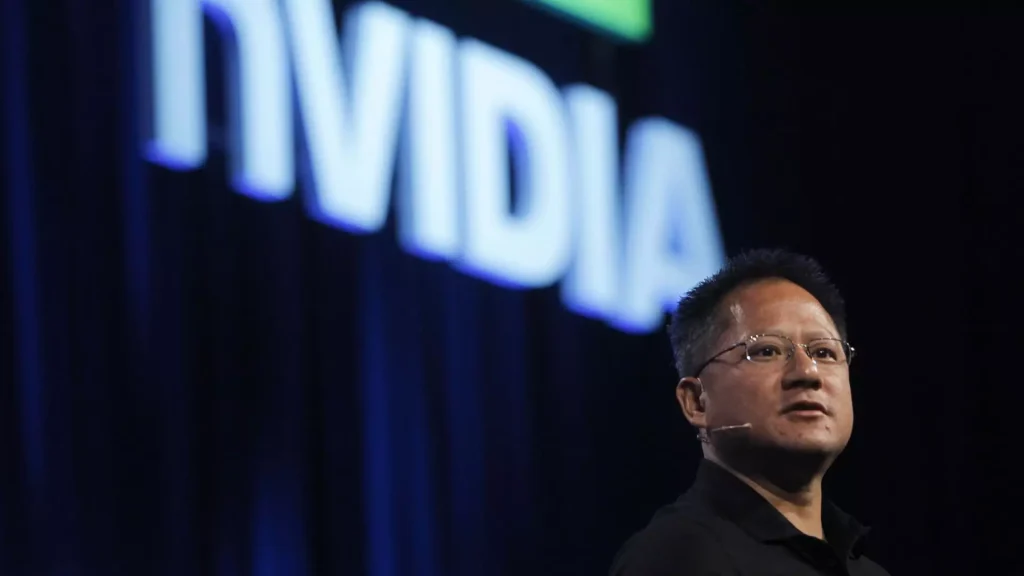

Nvidia: Leading the AI Revolution

Nvidia has established itself as a powerhouse in the technology sector, primarily due to its strategic focus on artificial intelligence (AI) and graphics processing. The surge in demand for AI applications positions Nvidia at the forefront of this transformative trend, with expectations of substantial new projects and partnerships on the horizon.

Analysts are optimistic about Nvidia’s future, projecting a significant rise in its stock price. This confidence stems from the company’s unmatched capabilities in scaling AI solutions, managing complex computing tasks, and fostering a robust developer ecosystem. As industries increasingly adopt automation and machine learning, Nvidia’s hardware has become a crucial element for progress. For investors, recognizing Nvidia’s potential is not just wise; it’s essential for capitalizing on the future of technology.

Netflix: A Streaming Giant’s Growth Trajectory

Netflix is far more than a fleeting trend; it is a transformative force in the entertainment industry. The company is adeptly navigating changing consumer preferences and has positioned itself as a leader in both original content and advertising technology. Recent analyst reports reflect renewed confidence in Netflix, with raised price targets underscoring its market dominance.

What makes Netflix particularly attractive is its continuous innovation and adaptability. Unlike many competitors that struggle with profitability, Netflix has developed a sustainable model for earnings growth and cash flow generation. The introduction of advanced advertising strategies not only showcases growth potential but also diversifies its revenue streams, potentially redefining its business model. Investors should seize the opportunity to invest in Netflix, as its unmatched scale and growth potential promise substantial long-term returns.

Boot Barn: Capitalizing on Lifestyle Branding

In a marketplace often overshadowed by fast fashion, Boot Barn stands out as a resilient player with impressive year-over-year growth. This Western-themed footwear and apparel retailer has recently seen analysts raise their price targets, reflecting a favorable outlook for the company.

Boot Barn’s success lies in its ability to connect with a specific lifestyle demographic, fostering a strong community around its brand. As the company expands its product offerings and enhances customer service, it is not merely competing on price but creating a loyal customer base. The current favorable pricing environment suggests that Boot Barn could capture market share from competitors. For investors, understanding the importance of branding and community engagement is vital in today’s competitive landscape.

Amazon: Innovating in E-commerce

Amazon continues to dominate both the retail and technology sectors, with innovative advancements in robotics and drone technology set to enhance operational efficiency. Analysts have raised Amazon’s stock price targets, highlighting its deep-rooted competitive advantages in the rapidly evolving e-commerce market.

These technological innovations are expected to reduce labor costs, increase delivery speeds, and improve overall operational accuracy, allowing Amazon to maintain its edge over competitors. As e-commerce expands globally, Amazon is not just riding the wave but actively shaping it. Investors should pay close attention to Amazon’s groundbreaking strides in operational efficiency, which promise robust returns in the future.

Philip Morris: A Strategic Shift Towards Healthier Products

Traditionally associated with tobacco, Philip Morris is undergoing a significant transformation by pivoting towards smoke-free products. This shift reflects a broader market trend toward healthier lifestyles, making the company increasingly appealing to forward-thinking investors.

Philip Morris’s strategic investments in alternative products position it as a leader in the development of reduced-risk offerings. As global regulations around smoking tighten, the company is not merely adapting; it is proactively embracing a new narrative that emphasizes innovation and harm reduction. This evolution presents a compelling investment opportunity for those looking to diversify their portfolios with companies that are poised to benefit from cultural shifts toward health-conscious choices.

Conclusion: A Diverse Investment Approach

Navigating the complexities of financial investment requires a keen eye for growth potential, and these five stocks—Nvidia, Netflix, Boot Barn, Amazon, and Philip Morris—represent diverse avenues for profiting in today’s fast-paced market. Each company showcases unique strengths and opportunities that could significantly impact the investment landscape in the coming years.

Investors who overlook these stocks may miss out on substantial growth opportunities. By incorporating these companies into their portfolios, investors can position themselves to benefit from transformative trends across technology, entertainment, retail, and health sectors. Embracing a diverse investment strategy that includes these promising stocks is essential for achieving long-term financial success.